Can True Wealth™ Planning bring meaning and purpose to your financial life? Let's find out!

Almost everyone I meet is afraid of becoming a burden to their family. I work with those people to custom design a financial roadmap to avoid becoming a burden before, during, and especially at the end of retirement. This is especially true for newly single adults, contemplating a "new" set of circumstances for which they had not planned.

Working with me means having a guide to help you clarify, organize, and prioritize your financial life decisions.

I do my best work with:

A recent (or soon to be) divorcee, widow or widower.

OR

Couples with “different” money management skills, interest or approach. Or where one spouse handled all the money decisions and can no longer be relied on for whatever reason – typically illness or death.

AND

1. All your assets (real estate, investments, retirement etc.) total a million or more.

2. It’s important to you to maximize the amount of your stuff that gets to your family rather than to the IRS or a nursing home.

3. You are comfortable paying a flat fee based on the complexity in your situation.

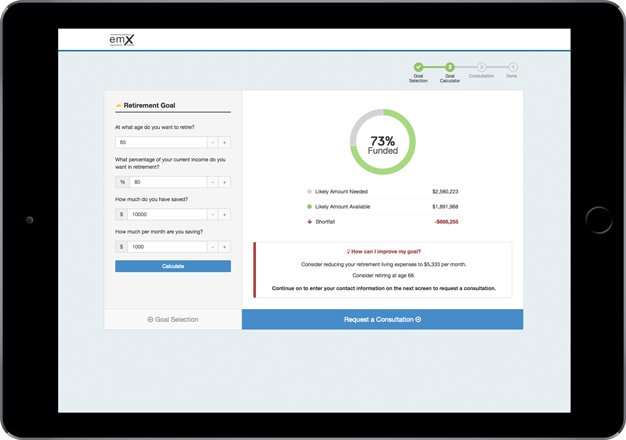

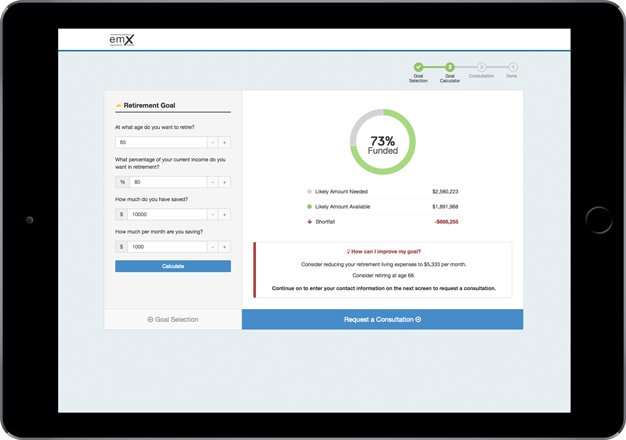

To start your investment plan, we just need to know a couple things about you: